Kazakhstan Cashing in on Cryptocurrency: Opportunities and Challenges for the World’s Third Largest Bitcoin Miner

Author: Daniel Lehmann

Jul 28, 2021

Recent fluctuations in cryptocurrency markets are creating substantial investment opportunities for Kazakhstan, but they also highlight the need for good, stable governance and a sustainable energy strategy. Kazakhstan is a growing destination for cryptocurrency miners, as the Caspian Policy Center previously analyzed. A 2021 study by the Cambridge Bitcoin Electricity Consumption Index affirmed this, noting Kazakhstan is currently the third largest producer of Bitcoin processing power, or the energy required to mine the cryptocurrency, behind China and the United States.

Despite China’s position as the largest cryptocurrency miner, Beijing’s recent actions limiting the use and mining of Bitcoin and other cryptocurrencies provides Kazakhstan with an opportunity to fill the gap in the rapidly growing sector. Kazakhstan has indeed capitalized on this prospect effectively in 2021, surpassing Russia’s production and inching towards 10 percent of global Bitcoin processing power. Kazakhstan’s market-oriented approach and sophisticated legal regime towards cryptocurrencies continues to attract foreign miners, create new investment, and to gain new tax revenues.

Unlike many countries where the legal status of cryptocurrencies remains uncertain, Kazakhstan created a relatively comprehensive legislative environment to attract investors to the burgeoning industry. Cryptocurrency mining is legal in Kazakhstan; with approval from the National Security Committee and notification to the Ministry of Digital Development, investors can begin mining activities. However, Kazakhstan conditions this ease of access by treating cryptocurrencies as property. So while the mining of Bitcoin and other digital currencies is permitted, they cannot be treated as a means of payment. Kazakhstan’s decision to allow tax-free import on crypto mining equipment allows Chinese miners forced out of their country a convenient fallback location. In May 2021 alone, Chinese investors introduced almost $10 million of investment capital into the construction of crypto farms in Kazakhstan. American minersand their capital are likewise drawn to Kazakhstan given the country’s low cost of energy.

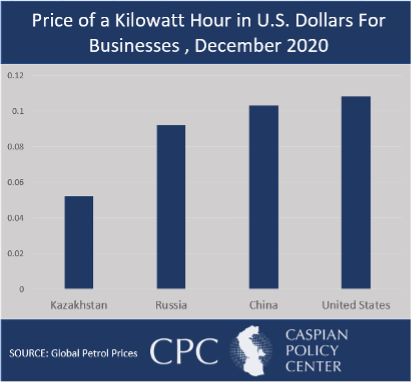

Kazakhstan’s cryptocurrency industry will likely be vulnerable to the energy-related challenges that the industry faces around the world. Starting in January 2022, registered crypto miners will be taxed an extra 1 tenge (or $0.0023) per kilowatt hour (kWh) used. This is about 4.5 percent more expensive than the energy usage rates other businesses in Kazakhstan face, and there is some concern this additional burden will scare away potential investors. While 1 tenge extra may not sound like a substantial cost increase, the Cambridge Bitcoin Electricity Consumption Index estimates that globally, Bitcoin alone uses 6.88 gigawatts a day, or 6.88 million kilowatts. Still, Kazakhstan remains poised to provide cheaper energy than many others.

At the same time, the massive use of electricity — mostly generated by fossil fuels — is an important concern regarding cryptocurrencies. The energy required to run mining computers 24-hours a day, plus the cooling equipment needed in large facilities, means cryptocurrency is an environmentally taxing industry. In 2018, Kazakhstan, in total, used 92 terawatt hours (tWh) of energy, and in 2020 global Bitcoin networks used 71 tWh. For Kazakhstan, where 86% of its energy still comes from fossil fuels, a growth in crypto mining could cause increased pollution and further deterioration of the environment. Additionally, as the cryptocurrency market grows, more powerful computers are needed to earn a profit. In the mid-2000s, a personal computer could mine cryptocurrency profitably, but by 2020 miners needed application specific integrated circuit chips (ASIC chips) to mine Bitcoin effectively and it was 16 trillion percent more difficult to produce a Bitcoin. These specialized chips require a tremendous amount of energy and acquiring a single Bitcoin now demands over 1700 kWh of electricity. Assuming this trend continues, the cryptocurrency industry in Kazakhstan, and globally, will continue to require more energy. Cryptocurrency mining could be made less harmful to the environment; miners in the United States have a smaller carbon footprint than miners in Kazakhstan because the U.S. uses more renewable energy. As Kazakhstan continues to diversify its energy sources, cryptocurrency mining will become less problematic.

While some cryptocurrencies seek to become more energy efficient, Bitcoin continues to set the standard, and its method of operation is widely replicated in other cryptocurrencies. Innovative strategies to reduce the footprint of cryptocurrencies continue to develop, but miners consistently prioritize energy costs over social or other impacts

In the short run, Kazakhstan continues to make itself an attractive investment destination for the cryptocurrency market, during a time many Chinese miners look for a new option. China seemingly grew wary of the unregulated nature of cryptocurrencies and their energy and environmental strain. Nur-Sultan’s cryptocurrency governance gives miners some assurances of stability and offers cheap energy costs that advance profitability. What remains to be seen is if Kazakhstan can use these new investments to mitigate the long run social costs of the industry, and if Kazakhstan’s energy grid can continue to meet the growing demand of crypto mining.

Image Source: Wikimedia Commons