The Middle Corridor: The Beginning of the End for Russia’s Northern Corridor?

Recent Articles

Author: Meray Ozat, Haley Nelson

06/30/2023

The Middle Corridor is looking to make drastic improvements as Kazakhstan, Georgia, and Azerbaijan inked an agreement on June 22 aimed to reduce operational delays, eliminate bottlenecks, and streamline the tariff process. As the West continues to uphold its economic offensive against Russia, improvements to this transport route are poised to impart a palpable blow to the financial shield safeguarding the Kremlin’s war efforts. However, although this agreement will address some of the route’s challenges, limitations surrounding port capacity and logistical constraints continue to impede the full realization of the Middle Corridor's potential. Because unlocking the route's potential can play a pivotal role in countering the economic foundations upon which the Kremlin relies, it has become imperative for foreign investors to expand their support.

Following Russia’s invasion of Ukraine, Caspian Region countries were confronted with the realization that Russia can no longer be a reliable partner, and the need to distance themselves from Russian influence grew increasingly apparent. At the same time, consumer markets in Europe faced the devastating consequences of their economic reliance on Russia as the Kremlin weaponized its role as a transit state. It became clear to both the Caspian Region and Europe that their traditional trade partnerships no longer aligned with the shifting geopolitical landscape. And as cooperation with Russian enterprises weakened, a window of opportunity emerged for trade diversification. With the loss of the Russian partnership, the Middle Corridor gained opportunities to develop.

The Middle Corridor trade route can provide an alternative to the Northern Corridor, a route that transports products from China, through Russia, to European consumer markets. The Middle Corridor is a multimodal land and sea transport corridor, helping products move from as far as China to Europe through Kazakhstan, Uzbekistan, Turkmenistan, Azerbaijan, Türkiye, the Black Sea, and the Caspian Sea. The route consists of over 4,250 km (about 2640.83 mi) of rail lines and 500 km (about 310.69 mi) of seaway. With its total length 2,000km shorter than Russia’s Northern Corridor, the Middle Corridor offers a resolution to sanction-compliance issues, access to new markets, and new opportunities for business-to-business (B2B) and business-to-government (B2G) engagements in logistics, transportation, and infrastructure construction. With these benefits, the route is quickly gaining popularity, particularly following Russia’s invasion of Ukraine.

A year after Russia first launched its attack on Ukraine, during the first half of 2023, the Middle Corridor was widely discussed in many high-level platforms, such as the China-Central Asia Summit, the 7th Trans-Caspian Forum, XIII Astana International Forum, the 49th G7 Summit, the Caspian Connectivity Conference, and the World Economic Forum. These platforms are highly supportive of the initiative to diversify the region and weaken Russian influence. Numerous representatives from Western countries, including the United Kingdom and the United States, have expressed their willingness to support the region by providing assistance in energy infrastructure development and the diversification of energy resources. In addition, foreign investment in the Middle Corridor also increased. During the recent G7 Summit, the G7 Partnership for Global Infrastructure and Investment proposed $600 billion in funding for the development of the Middle Corridor until 2027, underscoring their commitment to its progress.

As the G7 funnels in investments to help eliminate the Middle Corridor’s bottlenecks, Kazakhstan and Azerbaijan have developed a framework to drastically increase the volume of cargo transported across the Middle Corridor. Kazakh Prime Minister Alikhan Smailov announced that Kazakhstan is planning to increase trade volumes across the Caspian to Azerbaijan in over 100 commodity items worth over $300 million, bringing the annual bilateral trade volume to over $1 billion. As part of this planned cargo increase, Kazakhstan has expressed a desire to establish supplies of fruit and vegetables from Azerbaijan to Kazakhstan. With these plans in place, there has already been a significant uptick in Kazakhstan-Azerbaijan trade relations.

Within the first four months of 2023, the bilateral trade between Azerbaijan and Kazakhstan increased by $50 million, reaching US$183 million, marking a 40% growth compared to the previous year. The cargo delivered through the Middle Corridor reached one million tons in the beginning of 2023, an increase of 64% compared to the same period in 2022. In February, the Kazakh Ministry of Energy predicted an upward trajectory for the project, anticipating 6.5 million tons of cargo in 2023, 7.5 million tons in 2024, and 15 million tons in 2025. Also, the volume of oil transported from Kazakhstan’s Port of Aktau to Azerbaijan’s Port of Baku increased by 60.5 tons, or 75% in April 2023 when compared to March 2023. This is largely to do with the first successful shipment of oil across the Middle Corridor at the end of March 2023.

Similarly, the bilateral trade between Kazakhstan and Georgia reached $167 million during the same period, which increased fivefold compared to the same period last year.

However, this major capacity increase has exposed, and even exacerbated, bottlenecks across the corridor, causing delays and slowed transit times. Delays have extended the transit times to up to 40 days, or longer in some cases, making the corridor less desirable than the alternative Northern route. Additionally, the limited fleet capacity has increased transit prices due to high demand. This capacity vulnerability has led to volatile transport prices of the corridor, making it difficult for exporters to calculate total transit prices, further reducing the reliability of the route.

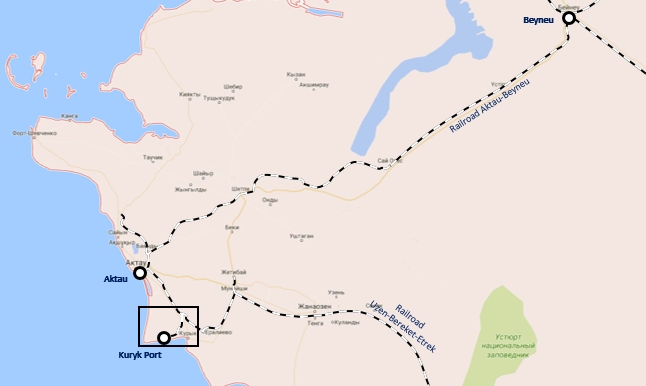

The primary concern lies in the insufficient infrastructure that hampers the route's effective operation. The absence of proper infrastructure, particularly in the Caspian and Trans-Caspian pipeline for oil and gas transportation, undermines the promising trend. Currently, to transport oil from Kazakhstan to Azerbaijan via the Middle Corridor, oil is first transported to either Kazakhstan’s Kuryk port or Aktau Port via railway, where it is then unloaded and reloaded onto a vessel and transferred to Baku where it is again loaded onto a train and transported to a pipeline. When compared to the ease of the Russian routes, from Kazakhstan to the Black Sea port via the Caspian Pipeline Consortium (CPC), the Middle Corridor process takes sufficiently longer and is more technically difficult.

Source: Kuryk Port Development

Commenting on the Middle Corridor’s insufficient capacity and essential infrastructure, during the 7th Trans-Caspian Forum, Chief Operating Officer at the Port of Baku, Eugene Seah said that these logistical hurdles have made the route less competitive compared to the Northern Corridor. While 1.41 million containers were delivered through the Northern Corridor in 2021, the “alternative” Middle Corridor is not even capable of handling 5% of that volume. In response to the inadequacies of the Middle, Eugene Seah stated: “It is not an alternative. You will still go back to your old ways unless we identify the key issues in our critical infrastructure.”

Limited railway and seaport capacities, the absence of a unified tariff process, and a lag in the digitalization of the ports’ operations have presented a series of hurdles to this Russian-alternative route. The capacity constraints are partially due to the shortage of ships on the Caspian Sea. In terms of oil transport, two of the three Kazmortransflot Caspian-Max tankers – capable of reaching the Caspian Sea through Russian riverways – are currently under a long-term charter to deliver oil between the Aktau Port and Russia’s Makhachkala port, thereby limiting the vessels that can operate along the Middle Corridor. In response, Azerbaijan and Kazakhstan have been actively working to expand their transit capacities and harmonize customs procedures.

Source: Kuryk Port Development

Source: Kuryk Port Development

To address existing weaknesses and challenges, Kazakh Prime Minister Smailov’s visit to Azerbaijan and Georgia on June 22-23 further facilitated discussions on the future development of the Middle Corridor. A major milestone achieved during these visits was the establishment of a joint logistics company for Azerbaijan, Kazakhstan, and Georgia. This company will be responsible for unifying tariffs and cargo regulations along the Middle Corridor, aiming to resolve challenges stemming from inconsistent rules and standards. Therefore, this agreement has the potential to significantly expedite cargo transportation across the Middle Corridor by simplifying processes and enhancing efficiency.

Prior to the trilateral union between Kazakhstan, Azerbaijan, and Georgia, the total transport time between China and Europe was 53 days. This new trilateral union is hoping to reduce the Caspian time to 18 days throughout 2023, and a further reduction to 10-15 in the subsequent years, making the total transport time between China and Europe less than 23 days. The fastened speed will provide the Middle Corridor with a comparative advantage surpassing the speed of the Northern Corridor, which currently requires 19 days for delivery.

As part of this trilateral agreement, Kazakhstan Prime Minister Smailov outlined other potential developments to help reduce bottlenecks and decrease transit time further. On this list of potential projects are the addition of two railway tracks on the Dostyk-Moyinty section, a container hub in the Port of Aktau, and a bypass railway line of the Almaty station. “We halved transit time through the territory of Kazakhstan from 12 to six days, and now we intend to reduce it to five days by the end of this year,” Smailov said. The agreements specifically focus on developing vital aspects such as digitalization, expanding transport routes, augmenting the supply of ships and railway locomotives, and the construction of fiber-optic communication lines.

Following the meeting with Azerbaijan leaders, Prime Minister Smailov proceeded to Georgia, where he met with Georgian Prime Minister Irakli Garibashvili to continue discussions on resolving the existing challenges of the Middle Corridor. The leaders have laid out plans to establish unified logistics, construct new ports, and enhance the digitization process of the Middle Corridor. To facilitate these changes, three main railway companies of Azerbaijan (Azerbaijani Railroads JSC), Georgia (Georgian Railway JSC), and Kazakhstan (Kazakh Temir Zholy JSC) signed a trilateral agreement on basic principles of creation and activity of joint ventures. The meeting also resulted in a clear roadmap for future development and the delineation of responsibilities among Azerbaijan, Kazakhstan, and Georgia for the next five years.

However, this new trilateral agreement does not stand alone. Since Russia’s invasion of Ukraine, several project agreements have been signed with the aim of boosting the Middle Corridor’s capacity.

In December 2022, Kazmortransflot (KMTF) signed an agreement with UAE-based AD Ports Group to launch a joint venture that will provide shipping services for energy companies operating in the Caspian Sea. AD Ports stated that it “will look at investments opportunistically” and it will offer “offshore support vessels, integrated offshore logistics, and subsea solutions and, at a later stage... container feedering, ro-ro (roll-on, roll-off cargo ships), and crude oil transportation in the Caspian Sea and the Black Sea.” The main objective is to jointly expand the capacity to carry 8-10 million tons of crude annually in the medium term.

On February 10, Kazakhstan’s Central Communications Service announced that both the Port of Aktau and the Port of Kuryk will be integrated into the Seaport Aktau special economic zone (SEZ). This move is aimed at upgrading the ports’ logistical capacities and their ability to transport products globally. Not only will this move help expand Kazakhstan’s international trade partners, but also the lax customs and inspection regulations offered at SEZs will attract new foreign investors into Kazakhstan’s Mangystau Region, where the ports are located. This development is especially significant because the Port of Aktau accounts for 40% of the Caspian Sea’s transport traffic, and the investments that the SEZ can attract could greatly help reduce transport time, streamline inspection processes, and eliminate bottlenecks that have plagued the Middle Corridor.

The inclusion of these ports into the SEZ has already benefited port capacity. The Kuryk Port Development is planning to construct a transport and logistics center to provide storage for various types of cargo and carry out all customs procedures; a bulk cargo terminal, designed for the transshipment of oil, bulk oil cargo, and LPG; a universal reloading terminal, intended for transshipment of general, bulk, and container cargo; and a production complex to fill the lack of production capacity for repair of medium and large vessels. And, on May 31, as part of the Special Economic Zone, the Port of Kuryk announced it will be adding a large cargo pier and a grain terminal to help accommodate the increased cargo flows.

Source: Kuryk Port Development

Source: Kuryk Port Development

As part of the Kuryk Port Development project, Semurg Invest, a Kazakh infrastructure company, has plans to build a new oil port terminal, which will increase the port’s export transport capacity to 15mn-20mn tonnes per year (tpy) of oil, or as much as 112mn barrels. This project, costing less than $100 million, will add a jetty with arms to load tankers and a local oil storage facility with a pipeline to the docks. The Kuryk Port has operated an oil terminal since 2017, but this project will help diversify the port’s export routes and expand capacity.

However, despite these ambitious projects and investments, it appears that the Middle Corridor is not meeting its initial high ambitions. Prime Minister Smailov in his recent comment mentioned an expected cargo volume of 10 million tons by 2027, which undermines the previous target of achieving 15 million tons by 2025. Despite the progress made with the Middle Corridor, which provides an alternative route to weaken Russian influence, the lack of comparative advantages for the Middle Corridor allows Russia to continue to dominate the trade between Asia and Europe.

To optimize the effectiveness of the Middle Corridor, Eugene Seah emphasized four key components for development, namely increasing railway infrastructure, boosting the capacity of Caspian ports, facilitating digitization, and establishing connectivity between the Caspian Sea and the Black Sea. Recent developments in the Middle Corridor during the meetings and discussions conducted thus far have made progress in addressing the first three components. To ensure continuous development, the countries along the Middle Corridor should also work on building connectivity between the Caspian and the Black Sea, enabling smooth cargo delivery to the European continent.

To unlock the full potential of the Middle Corridor and establish it as a viable alternative to the Northern Corridor, two preconditions need to be met: investment and security. According to the estimates by the European Bank for Reconstruction and Development, the Middle Corridor requires an investment of $19-21 billion to address the aforementioned challenges. Moreover, maintaining a peaceful environment is crucial to ensure the smooth and uninterrupted operation of the Middle Corridor. It is imperative to de-escalate conflicts such as the one between Azerbaijan and Armenia, preventing any potential disruptions to the Middle Corridor. Therefore, regional countries must collaborate harmoniously, actively working towards both peace and attracting investments to maintain their competitiveness.

While Russia continues to sabotage its international reputation and trade partnerships, it is not only imperative for the region, but also for broader international trade networks, to recalibrate their partnerships and seek viable alternatives to Russia. The Middle Corridor offers an ambitious opportunity to diversify trade portfolios away from Russia. However, to fully depart from Europe’s Russian-centric trade routes, investors and governments must remain committed to the fruition of this project, despite the many obstacles presently impeding its realization.