Kazakhstan’s Surprise: The Impact of Trump Tariffs on Central Asia and the Caucasus

Recent Articles

Author: Ali Dayar

04/07/2025

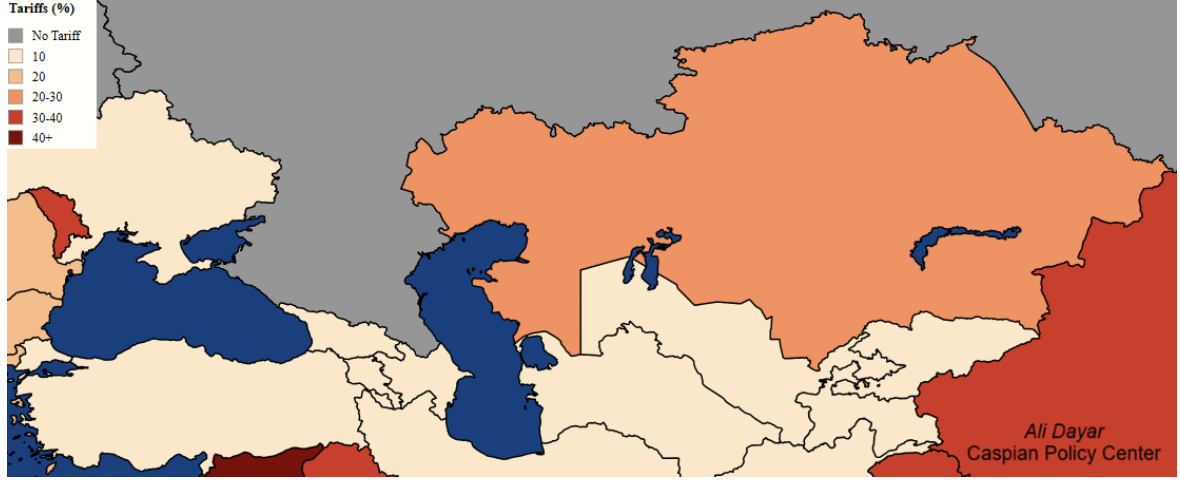

While the international community tries to position itself amidst the U.S. announcement of global trade tariffs, details of the executive order reveal many exempt products. For Kazakhstan, the only country in the trans-Caspian region facing 27% tariffs, the devil is in the details. The share of exemptions in the composition of a country’s exports to the U.S. determine the real impact of the new tariff policy on bilateral trade relations. The re-implementation of a U.S. tariff regime on global trading poses challenges, requiring quicker action to address or remediate the effects of the tariffs. For Kazakhstan, a 27% tariff might have a comparatively lower impact.

The White House Executive Report includes an annex listing a large number of goods exempt from the new tariffs. Kazakhstan’s major exports to the United States, including oil, uranium, and metals, are all exempt, leaving 95.2% of Kazakhstan’s exports unaffected by the recent measures. As a result, the effects of the tariffs on Kazakhstan could well differ significantly from those on other countries, even if the overall rate appears higher. The rising importance of Caspian energy and critical raw materials likely influenced the selective application of the protectionist trade policy against Kasakhstan.

Kazakhstan is an important trade partner for the United States in the Caspian region. The U.S. government estimates that bilateral trade in 2024 accounted for about $3.4 billion, making Astana the country with the largest trade volume with the United States among post-Soviet states. Bilateral trade relations have generally been on a positive track for decades, but they improved markedly since Washington spearheaded the C5+1 format and renewed discussions on repealing the Jackson-Vanik amendment.

The new U.S. tariff regime hits Kazakhstan harder than any other trans-Caspian country.

The new U.S. tariff regime hits Kazakhstan harder than any other trans-Caspian country.

The April 3 introduction of tariffs on a global scale, targeting nearly every country the United States trades with. The U.S. Trade Representative calculated the tariff rates based on trade deficits, in an effort to drive them to zero bilaterally. Most countries received a 10% minimum tariff rate, regardless of whether the United States has a surplus or a deficit with them. As Caspian countries generally have balanced trade relations with the United States, all received the 10% base rate, with the exception of Kazakhstan’s significantly higher tariff.

U.S. tariffs on global markets position the trans-Caspian region’s trade somewhat differently due to raw-material and other similar exemptions. The new tariffs mainly target manufactured products, adding to prior tariffs targeting finished products, such as cars and automotive parts. On March 26, the U.S. government imposed a 25% tariff on those categories, impacting countries with major automotive exports to the United States, including Germany, South Korea, and Japan. The exemptions and specific focus of the tariffs affect countries differently depending on their bilateral trade composition, which helps explain why the Caspian region led by Kazakhstan remains relatively unaffected.

However, it should be noted that the composition of U.S.-Kazakhstan trade appears to be calculated somewhat differently by each partner. A Kazakhstan government official states that their estimates put imports from the United States at about $2.2 billion, rather than $1 billion. This discrepancy between U.S. and Kazakhstani figures raises questions about how trade imbalances will be determined during potential up-coming tariff negotiations. Time will tell.